Discrete Share Price Performance (%)

12 months to end ofDec 2025Dec 2024Dec 2023Dec 2022Dec 2021

Edinburgh Investment Tst plc10.014.813.32.522.0

IT UK Equity Income20.89.82.9-4.317.8

FTSE All Share24.09.57.90.318.3

Net Asset Value10.014.813.32.522.0

Quartile Ranking42111

Source: FE fundinfo as at 27/02/2026. Performance figures are shown in GBX and in total return terms, with net dividends reinvested.

Cumulative Share Price Performance (%)

As at previous day end1 month3 months6 monthsYTD1 year3 years5 years10 yearsSince Inception

Edinburgh Investment Tst plc2.12.53.82.39.033.977.787.5354.1

IT UK Equity Income5.011.314.57.425.439.966.1115.6703.5

FTSE All Share6.512.518.19.727.950.688.7151.11016.2

Net Asset Value2.12.53.82.39.033.977.787.5354.1

Quartile Ranking34444324

Source: FE fundinfo as at 27/02/2026. Performance figures are shown in GBX and in total return terms, with net dividends reinvested.

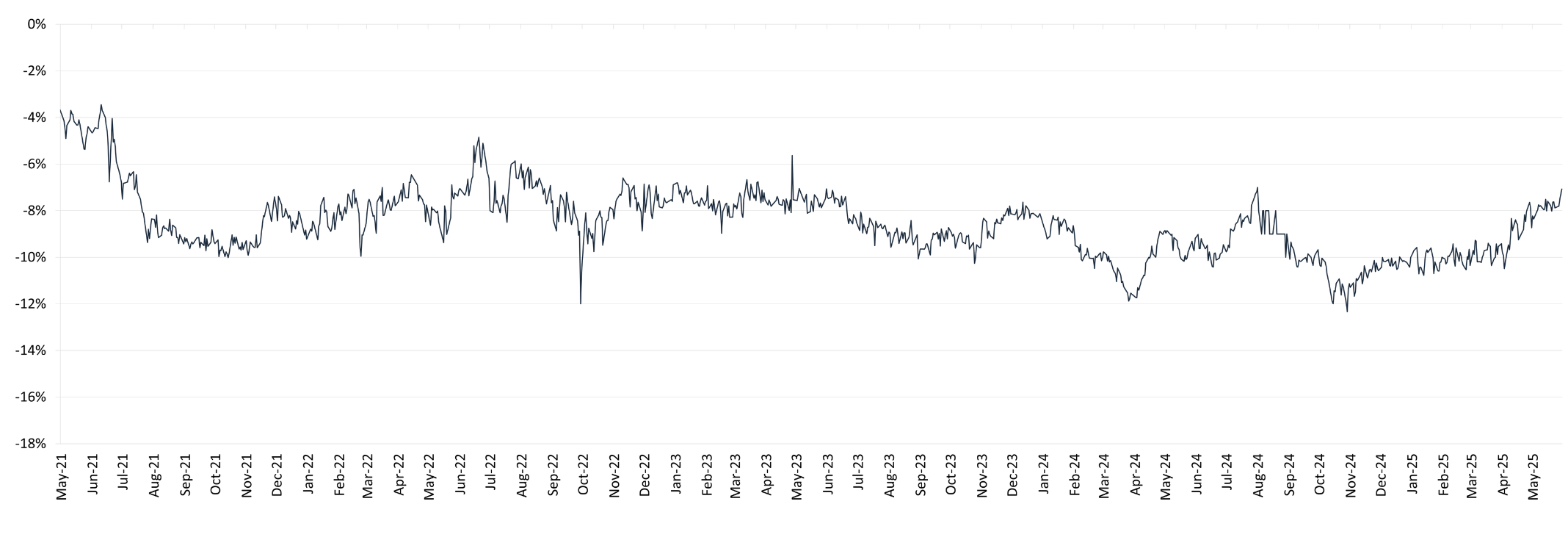

Premium/Discount history

If a trust’s share price is higher than its net asset value (NAV) then it is said to be trading at a ‘premium’; if the share price is below the NAV then it is trading at a ‘discount’. A figure above 0 is a premium and one below 0 is a discount.

Source: Bloomberg as at 31/01/2026. Cumulative income net asset value (debt at fair value).